additional tax assessed by examination

This article appeared in the MayJune 2010 edition of Taxation of Exempts. Complete the following sentences by clicking on the correct answer.

A Step By Step Guide To Form 1116 The Foreign Tax Credit For Expats

6 The tax practitioner cannot file the return without the clients cooperation but also could not be associated with any tax return that would be rendered inaccurate by the clients refusal to file a State A tax return.

. 442513 Follow-up on Quick Assessment Form 3210 CCP or Campus Examination Procedures. A tax assessment is a number that is assigned by the taxing authority of your state county or municipality depending on where the property is located as the value of your property. 7-568 re additional property tax to pay current years expenses.

The department shall notify the taxpayer by mail. The most aggressive tax-exempt organization enforcement initiative to date has provided lessons to the entire EO community. And the IRS can also file a potential tax lien or levy on the taxpayers account which can result on the IRS seizing the taxpayers assets such as a car or other property or garnishment of the taxpayers wages through their employer.

Do not route to Exam. Exploring Tax Audit Selection. The assessment is levied for a.

There shall be a committee for the purpose of establishing a program and procedures for the training examination and certification of assessment personnel appointed by the Secretary of the Office of Policy and Management and consisting of. Usually in the case of an examination of a tax return the examination may have been initiated due to mistakes made in the preparation of the return or the IRS is challenging a particular item or issue on the tax return that may be a gray area. An examination of a tax year after the statute of limitations is expired is an unnecessary examination because generally no assessment of tax can be made for an expired year.

The IRS characterized the 10000 fringe benefit amount as additional 2016 wages and assessed 4030 in total employment tax against the employer2500 for federal income tax 765 for the employers share of Federal Insurance Contributions Act FICA taxes and 765 for the employees share of FICA. I received a letter with additional tax assessed 07254-470-65757-5 with an owed amount of 2871 plus interest. 4425141 Follow-up on Form 3552.

Agreement to Assessment and Collection of Additional Tax and Acceptance of Overassessment. There is a distinction between your assessed value and. The following is an example of a case law which defines an additional assessment.

Refer to IRM 41321 ResearchInitial Case Screening through IRM 41324 Reconsideration Calls Received in Exam Operation for information to determine if the case. Contact the taxing authority if you need additional information about a specific charge on your real estate tax bill. PROPERTY TAX ASSESSMENT See Sec.

The IRS Tax-Exempt Examination Process. The IRS relies on a combination of random selection and specific triggers to flag tax returns that they believe. Assessment of additional tax 5449-6.

A special assessment tax is a local tax in addition to property taxes that is levied on homeowners to fund a specific project. When the IRS selects a tax return for further study it carries out an. Notwithstanding the above IRS does not have to prove that the statute of limitations is open before starting an examination.

For example the IRS uses random sampling information comparison and computerized screening to select returns for audits. The assessment is multiplied by the tax rate and that is how your annual tax bill is calculated. The taxpayer may also face additional interests and penalties in addition to assessed tax liability.

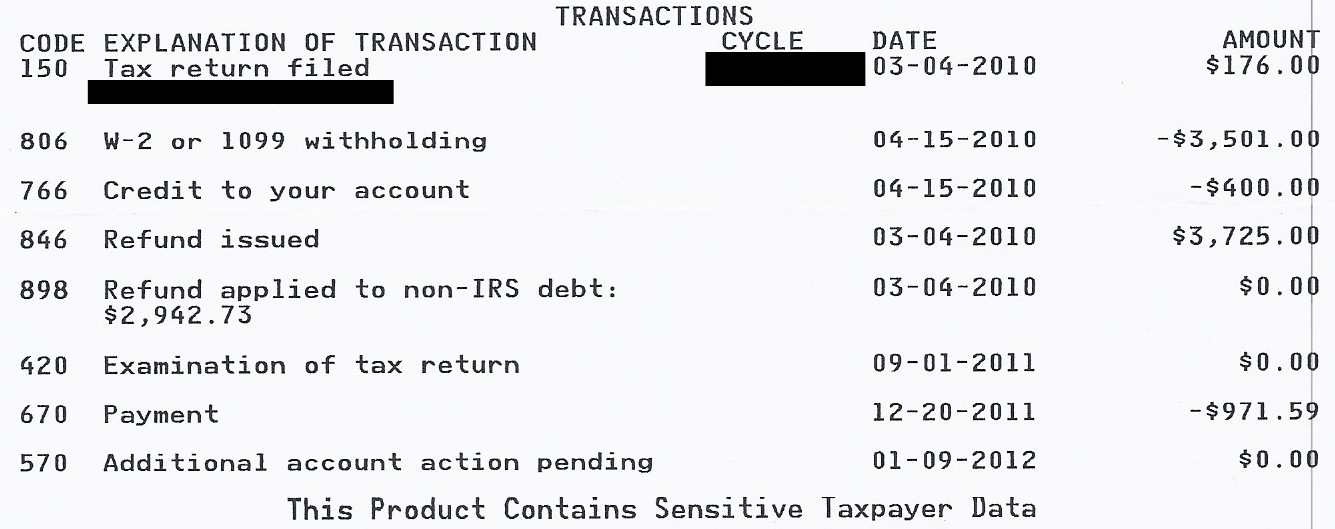

575 rows Additional tax assessed by examination. The term additional assessment means a further assessment for a tax of the same character previously paid in part and includes the assessment of a deficiency Riverside Dan River Cotton Mills Inc. Code 290 Additional Tax Assessed on transcript following filing in Jan.

In 2003 the Service began a compliance project focused on. An Examination and Audit. 442514 Quick Assessment Verification Form 3552 CCP or Campus Examination Procedures.

Assessment of additional tax 5449-6. 5 Circular 230 1034 a 1. Just sitting in received.

Generates TC 421 to release 42 Holdif Disposal Code 1-5 8-10 12 13 34 and TC 420 or 424. United States 69 Ct. An examination is the same thing as an audit.

This number is called your tax assessment. Additional Tax or Deficiency Assessment by Examination Div. I was accepted 210 and no change or following messages on Transcript since.

As a general rule the IRS must assess additional tax and propose penalties no later than 3 years after either a tax return is filed or the returns due date whichever is later. The IRS selects taxpayer returns for examination for a variety of reasons. After a return or report is filed under the provisions of any State tax law the director shall cause the same to be examined and may make such further audit or investigation as he may deem.

Assesses additional tax as a result of an Examination or Collection Adjustment to a tax module which contains a TC 150 transaction. 442515 Second Adjustment Document Form 5344 or Form 5403 CCP Responsibility. Examination of return report.

The discriminant function system is a computerized system used by the IRS. An assessment is the recording of the tax debt on the books of the IRS. Just noticed on my transcript additional tax assessed 000 right around the time i filled in Jan.

Continue to Part 2 or to assess your answers click the Check My Answers button at the bottom of the page. 5449-6 - Examination of return report. Your Role as a Taxpayer.

Special assessment taxes are only deductible when they are paid to fund maintenance or repairs Non deductible Special assessment taxes that increase the value of a property are added to a propertys cost basis. 1 If upon examination of any returns or from other information obtained by the department it appears that a tax or penalty has been paid less than that properly due the department shall assess against the taxpayer an additional amount found to be due and shall add interest as provided in RCW 83100070 on the tax only. 79 rows Examination cases closed as Non-Examined with no additional tax assessed do not meet the definition and criteria of an Audit Reconsideration.

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

Tax Administration Responses To Covid 19 Measures Taken To Support Taxpayers

/u-s-tax-filing-1090495926-21c69e6cc0ba4db0894841c99b26adbf.jpg)

Notice Of Deficiency Definition

Joint And Separate Assessment Acca Global

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

Pin On Printable Business Form Template

Revision Exercise With Key Notes O Level Poa Assessment Book Tuition O Levels Syllabus

Get Gst Registration Gst Return By Expert Professionals At Affordable Prices Types Free Consultation Experts 20 Ye Goods And Service Tax Goods And Services

About Tutor Mr Wynn Khoo For More Information Contact Admin Poatuition Com Sg Http Www Poatuition Com Tel 81356556 Tuition Tuition Centre Tutor

Irs Transcript Transaction Codes Where S My Refund Tax News Information

Joint And Separate Assessment Acca Global

What To Do With Math Error Notice Letters From The Irs Journal Of Accountancy

The Official Guide For Gmat Quantitative Review 2017 With Online Questions Gmat Gmat Exam Writing Assessment

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Income Tax Assessment Taxbuddy

What To Do With Math Error Notice Letters From The Irs Journal Of Accountancy